Iron ore is one of the most widely known, exploited and needed metals in the world. Australia, Brazil and China are the world's largest producers of the metal, the first two focussing on supplying the international market and China producing mainly to supply the local steel industry.

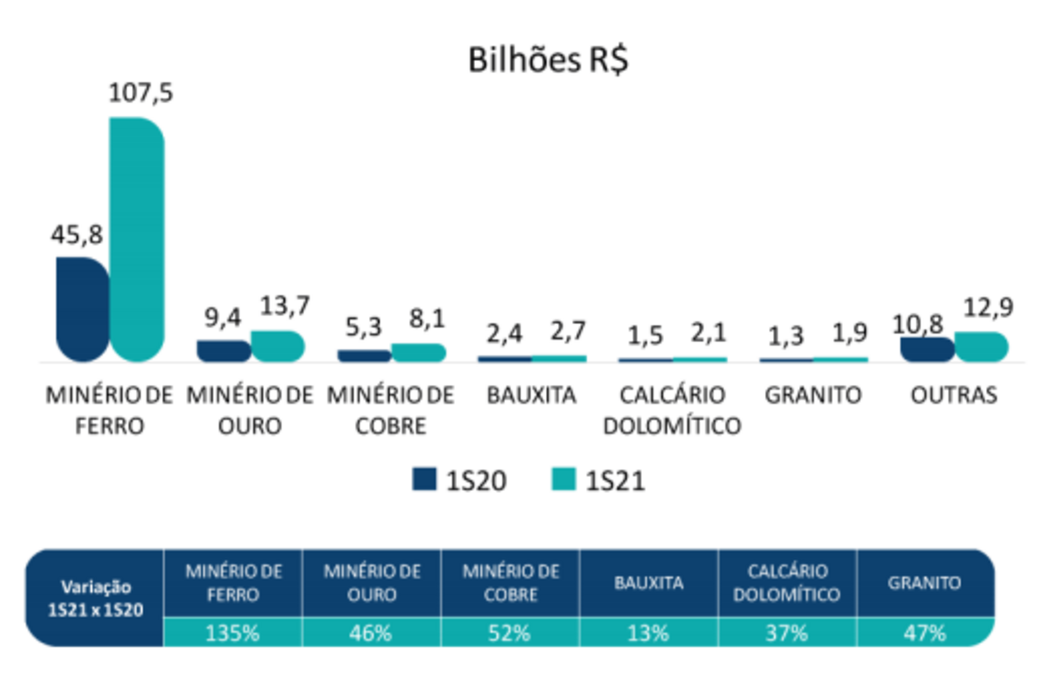

Iron mining is of great economic importance in Brazil due to the resources invested and the financial returns involved.

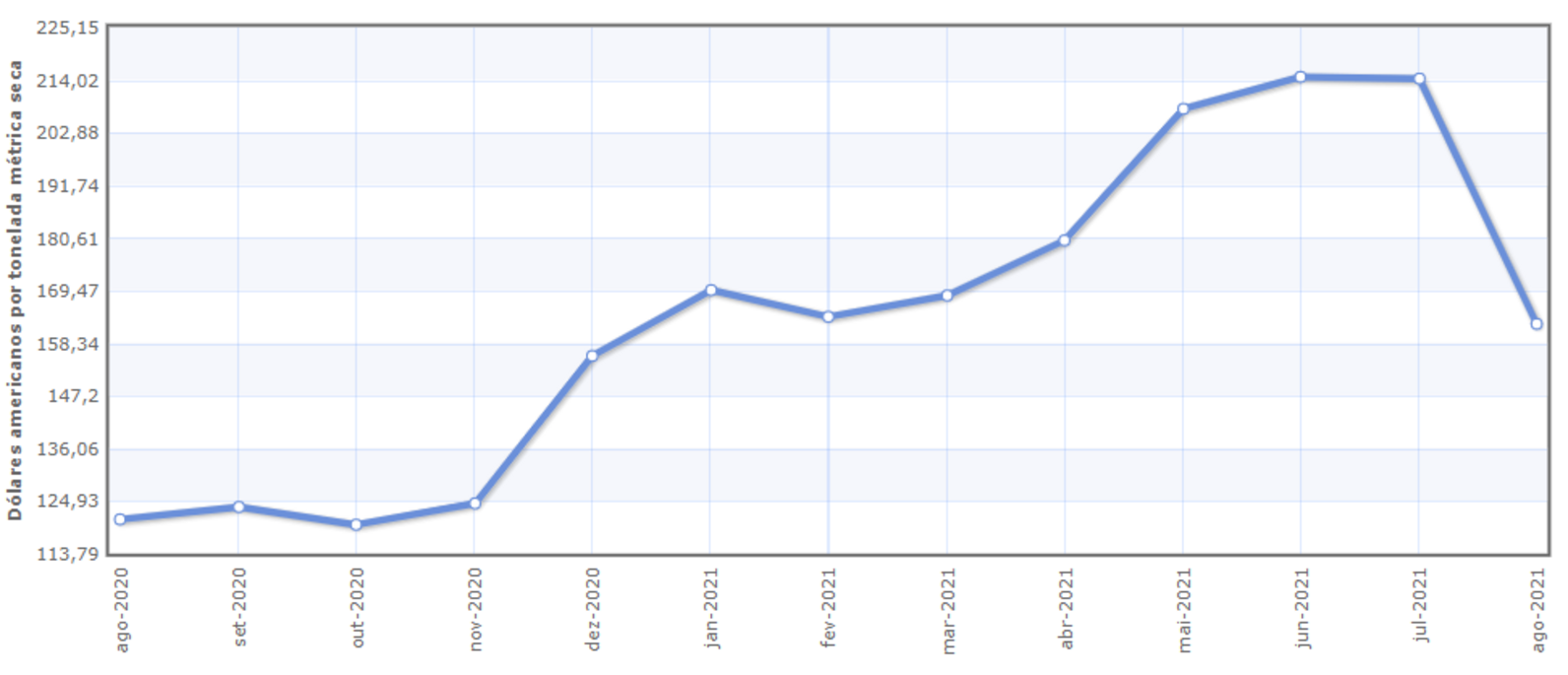

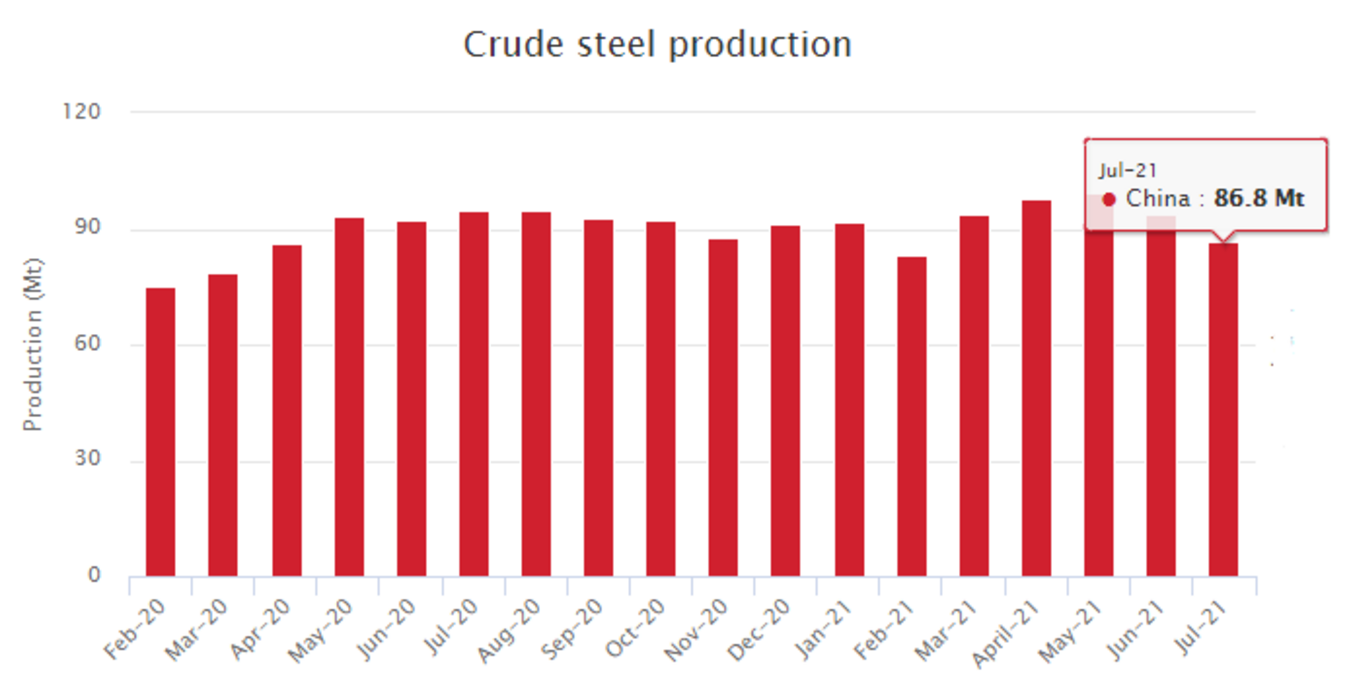

According to IBRAM data, China is the destination of 64.5 per cent of Brazil's iron ore exports. In this sense, the main use and demand for iron ore is steel production, which justifies this market's close relationship with China, the world's largest steel producer (USGS, 2017).

If you're interested in this subject, read this content to the end. In this article, we'll talk about iron ore and the main producing companies, market value and factors that influence the production of this mineral commodity.