Brazil is a major agricultural producer and the world's fourth largest exporter of agricultural products, meeting both domestic and foreign demand. This scenario would not be possible without the use of mineral fertilisers, including potassium.

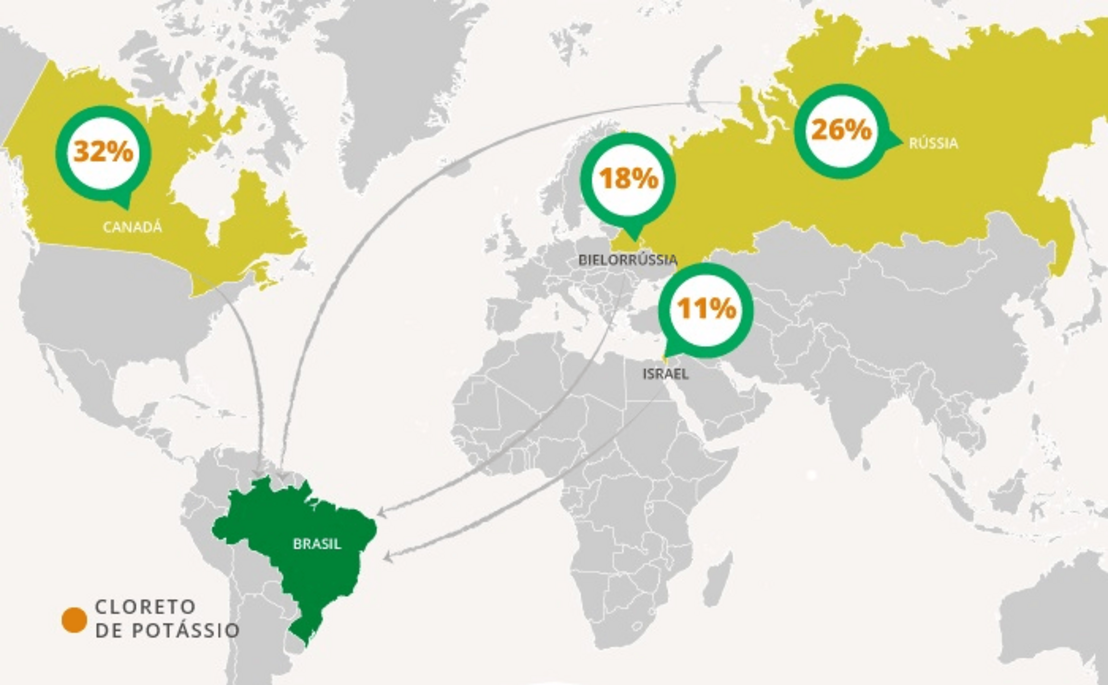

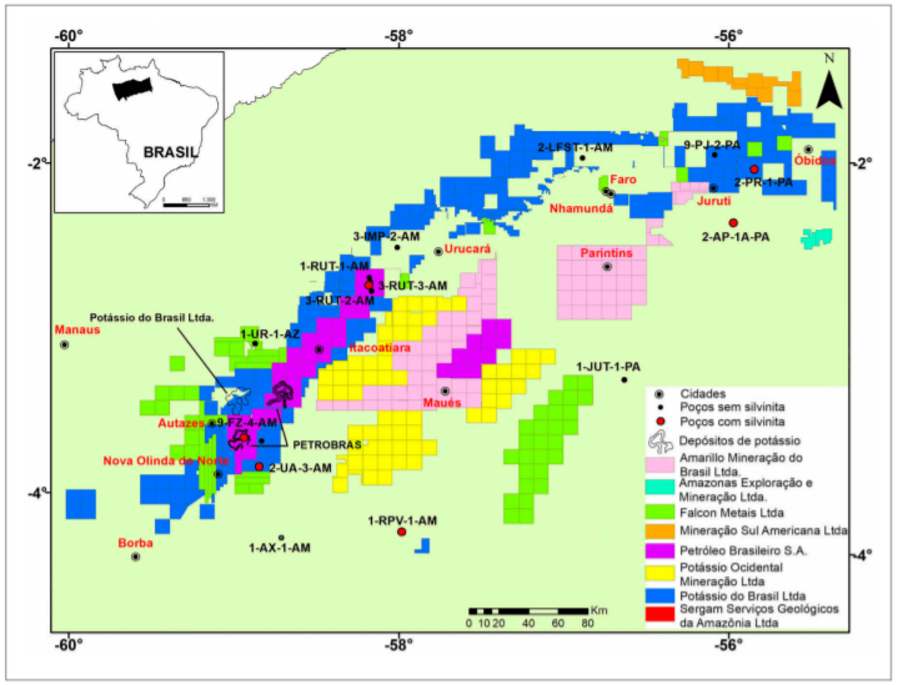

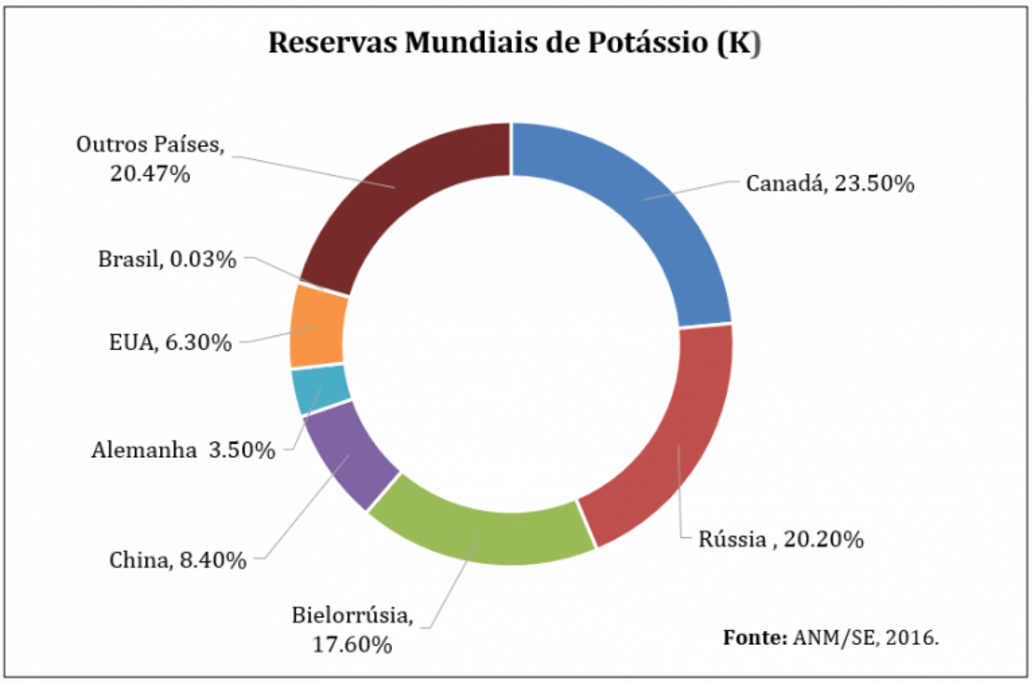

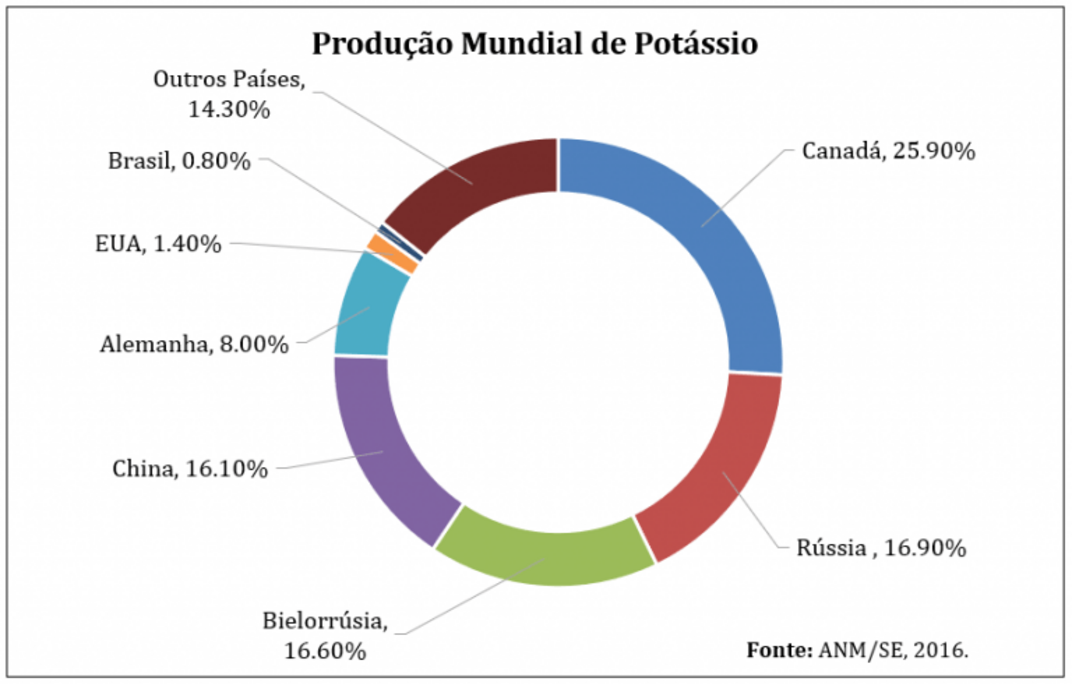

Potassium is one of the basic elements in the production of NPK fertilisers (Nitrogen, Phosphorus and Potassium compounds). Potassium minerals are considered strategic in Brazil, which is unfortunately highly dependent on foreign sources. Against this backdrop, research aimed at minimising dependence on agro-mineral imports has been carried out by the Geological Survey of Brazil (SGB/CPRM), as well as private companies.

Potassium is found mainly in evaporite deposits. The most common occurrence is sylvinite, which is a mixture of halite and sylvite. Its main application is in the manufacture of fertilisers, accounting for around 95% of world production. However, the chemical industry consumes the remaining 5% in the production of reagents, detergents, explosives and fireworks. Today's article will present the main sources, the market and the reserves of potassium, as well as new research and projects underway in Brazil.