The coronavirus (COVID-19) has already caused the deaths of more than 3,000 people in China (1) and almost 4,000 people in other countries. Three hundred and one cases of the disease have been confirmed in Brazil, with a further 2,000 suspected cases(2).

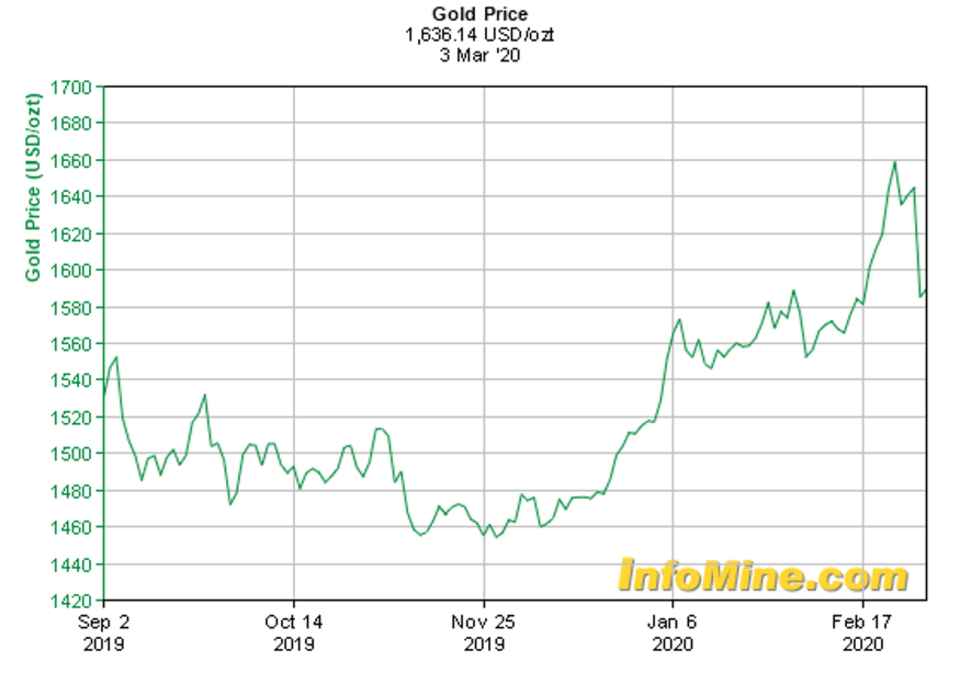

In addition to the enormous and regrettable human losses, the increase in cases outside of China has caused a major downturn in the main capital markets around the world. The fear of a pandemic and the consequent downturn in global economic activity has caused panic on the world's main stock exchanges and throughout the production chain in general.

In an increasingly globalised world with interconnected production processes, a crisis of this size in one of the world's largest production parks affects practically all industrialised countries.

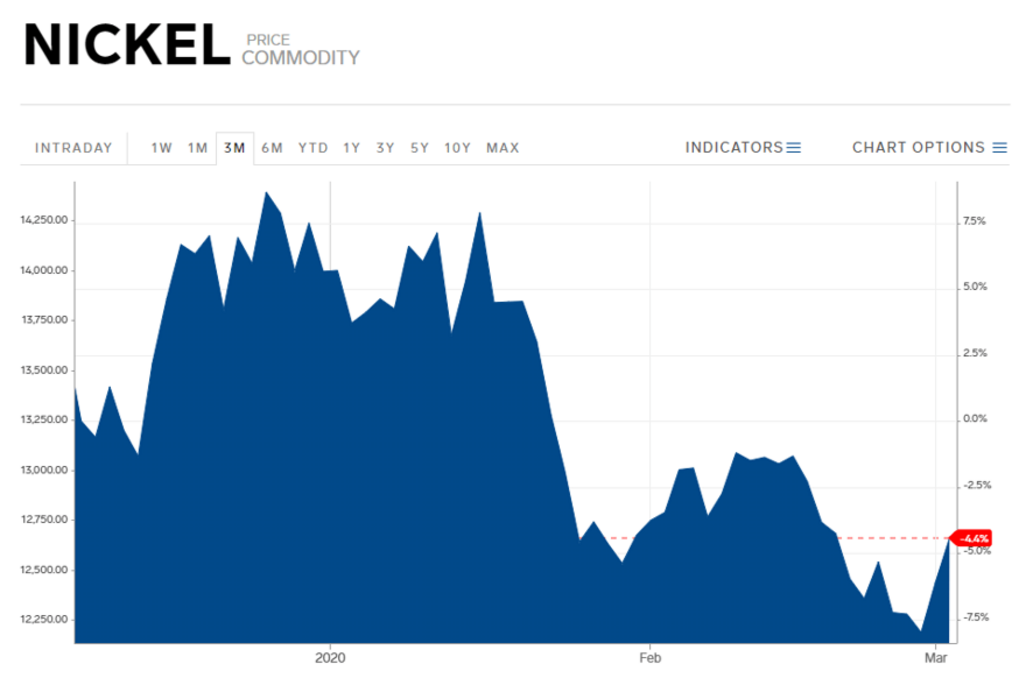

In the mining sector the situation is no different. With China as the main consumer market for most mineral commodities, mining companies fear that the fall in Chinese economic activity will lead to a fall in demand for mineral inputs.

In part, this is already happening: in parallel with the release of data on the contraction of Chinese industrial activity in February, reaching levels close to those seen in 2004(3), Brazilian iron ore exports also fell by 23.6% in February compared to the same period in 2019(4).

In addition to the impact on the consumer market for its products, the Brazilian mineral industry is also suffering from imports of equipment and parts. With the advance of the disease in China, several factories have stopped operations, drastically reducing the manufacture and availability of machinery for a wide range of sectors.

Despite the negative outlook for the industry worldwide, analysts believe that the real impacts on the world economy may be mitigated with the end of winter in the northern hemisphere and progress in research into vaccines and medicines against the disease.

In any case, the Brazilian mineral industry, which is still recovering from the international commodities crises and the political and economic crisis experienced in the second half of this decade, will face major challenges this year with the reduction in demand and prices for its main mineral goods.